In the ever-evolving world of finance, understanding the relationship between economic indicators and investment choices is crucial. Economic indicators serve as vital signs of a nation’s financial health, influencing decisions made by investors, businesses, and policymakers. By analyzing these indicators, one can gain insights into potential investment opportunities and risks. This essay about “The Impact of Economic Indicators on Investment Choices” will explore the various economic indicators and their impact on investment choices, highlighting the importance of being informed in a dynamic market environment.

Understanding Economic Indicators

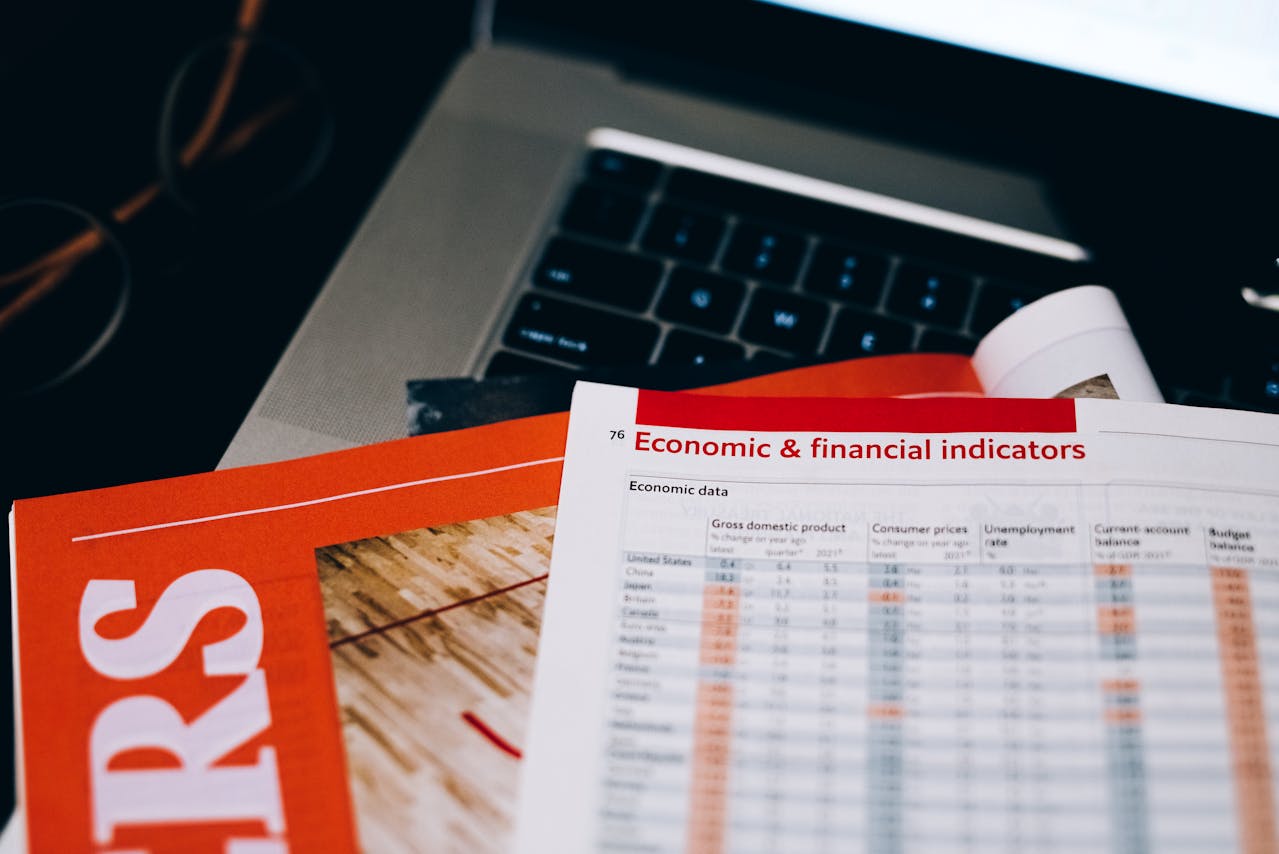

Economic indicators are statistical metrics that reflect the overall economic performance of a country. They are typically categorized into three main types: leading, lagging, and coincident indicators. Leading indicators, such as stock market performance and consumer confidence, tend to predict future economic activity. Lagging indicators, including unemployment rates and corporate profits, provide insights after economic changes have occurred. Coincident indicators, like GDP and industrial production, reflect current economic conditions.

These indicators play a significant role in shaping investment strategies. For instance, when leading indicators show positive trends, investors may become more inclined to invest in equities, anticipating growth. Conversely, negative trends in lagging indicators might lead to cautious behavior, causing investors to shift towards safer assets like bonds or gold.

The Role of GDP

Gross Domestic Product (GDP) is perhaps the most widely recognized economic indicator. It measures the total value of goods and services produced within a country over a specific period. A rising GDP often signals a growing economy, encouraging investments in various sectors. In contrast, a declining GDP can prompt investors to reconsider their strategies, often leading to a shift towards more stable investments.

Transitioning from GDP, it is essential to recognize that investors also pay attention to GDP per capita. This indicator reflects the average economic output per person and can provide insights into the living standards within a country. Higher GDP per capita often correlates with increased consumer spending, which can drive growth in various sectors, thereby attracting investors.

Unemployment Rates and Their Implications

Unemployment rates serve as another critical economic indicator. A low unemployment rate typically suggests a robust economy, where job creation is prevalent, and consumer spending is likely to increase. In such scenarios, investors may feel more confident in equities, particularly in sectors such as retail and services.

However, a rising unemployment rate may signal economic distress. In response, investors might consider reallocating their portfolios to include more defensive stocks or bonds. Thus, understanding unemployment trends can greatly influence investment choices.

Inflation and Interest Rates

Inflation is a vital economic indicator that affects purchasing power and investment returns. Moderate inflation is often seen as a sign of a growing economy, yet high inflation can erode investment returns. Investors closely monitor inflation rates, as they can significantly impact interest rates set by central banks.

When inflation is high, central banks may raise interest rates to control it. Higher interest rates can lead to increased borrowing costs, which may dampen consumer spending and business investment. Consequently, this environment may drive investors toward fixed-income securities, as bond yields may become more attractive compared to equities.

The Consumer Confidence Index

The Consumer Confidence Index (CCI) is another crucial economic indicator. It measures how optimistic or pessimistic consumers feel about the overall economic situation and their personal financial prospects. A high CCI typically correlates with increased consumer spending, which can boost corporate profits and, in turn, attract investors to the stock market.

Conversely, a low CCI may lead to decreased spending, potentially causing a slowdown in economic growth. Investors, therefore, often watch the CCI closely, as it can influence their confidence in various markets.

The Impact of Global Economic Indicators

In an increasingly interconnected world, global economic indicators also play a role in shaping investment choices. For instance, the performance of major economies like the United States, China, and the European Union can have far-reaching effects. Investors often assess global GDP growth rates, trade balances, and geopolitical events to inform their investment decisions.

Moreover, foreign exchange rates can also impact investment choices. A strengthening domestic currency can make exports more expensive, potentially affecting companies reliant on international markets. Investors may then adjust their portfolios accordingly, shifting their focus to sectors less affected by currency fluctuations.

Transitioning Investment Strategies

As economic indicators fluctuate, so too do investment strategies. A proactive approach to investing often involves regularly reviewing and adjusting one’s portfolio based on current economic conditions. Investors are encouraged to remain informed about economic reports and forecasts, as these can provide valuable insights into market trends.

Furthermore, diversifying investments across different asset classes can help mitigate risks associated with economic volatility. By understanding the interplay between various economic indicators, investors can make more informed decisions, leading to potentially higher returns.

Conclusion

In conclusion, the impact of economic indicators on investment choices cannot be overstated. By closely monitoring GDP, unemployment rates, inflation, consumer confidence, and global economic conditions, investors can gain valuable insights into market dynamics. As the financial landscape continues to evolve, staying informed about these indicators will be essential for making sound investment decisions.

In a world where market conditions can change rapidly, a thorough understanding of economic indicators will enable investors to navigate complexities more effectively. Ultimately, this knowledge serves as a crucial tool in the pursuit of financial success, underscoring the importance of being an informed investor in today’s dynamic environment.